Even Top Business Owners in Hong Kong Need Finance Tips They Can Use

It does not matter what the current stage of your business is because accounting is an aspect which cannot be neglected. Some people could underestimate its importance but it could make you miss out on details that need your attention. This is especially true when it comes to managing the finances of your business. Even large companies have healthy money habits because they do not want to lose what they have. In addition, this is applicable even to the business owners in Hong Kong because they have managed to survive despite the tough competition.

It does not matter what the current stage of your business is because accounting is an aspect which cannot be neglected. Some people could underestimate its importance but it could make you miss out on details that need your attention. This is especially true when it comes to managing the finances of your business. Even large companies have healthy money habits because they do not want to lose what they have. In addition, this is applicable even to the business owners in Hong Kong because they have managed to survive despite the tough competition.

Keep it Lean

Unimportant expenses which seem to be insignificant will only add up as time goes by. You should not spend on things you do not need. One of them is not hiring new staff until manpower is really required. You should actually be cutting costs in the early stages as much as possible. There are 2 types of costs in a business – fixed cost and variable cost. Fixed costs, like software and working space, should only be minimal. Try to rent out a co-working space if you want to begin holding meetings online. You can also try lessening administrate overheads when you barter for services. The final rule in keeping lean is about having a return on investment. In case there is a logical path that you see between purchasing and revenue increase, then it is probably worth it to spend money.

Increase Your Network and Be Proactive

You should be a proactive entrepreneur and meet potential future investors because networking in Hong Kong is great. An investor can introduce you to other investors or partners who can help you strategize on the innovation of your company. This is a huge advantage for startup businesses because it is very easy to meet investors in Hong Kong than other cities.

Do Not Keep Excess Capital

A lot of successful investors have stated that diversification in the investment portfolio of your business is important to success. In case your business has excess cash, you might not be effectively diversifying that capital. It has the same risk profile that is present in your business. You can take that out and invest your money in something that has a different risk profile than what your business has.

Learn How to Do Pricing the Right Way

It is great to save on any cost, but the same goes for your business goal in generating profits and revenue. An important part of this is to know exactly what price to give your products and/or services. Pricing is an art and science, and it is something that a lot of first-time entrepreneurs are not able to determine. The sad thing is that the majority of business owners simply choose an arbitrary number in the industry and they use it as the pricing point. Most of the time, this leads to undercharging, which affects the low-profit margin of any small business.

The main thing is to determine the price and what the value of your product or service is. By having an understanding of the problem that you are solving for customers, you can have a more effective pricing strategy.

Have a Detailed Plan

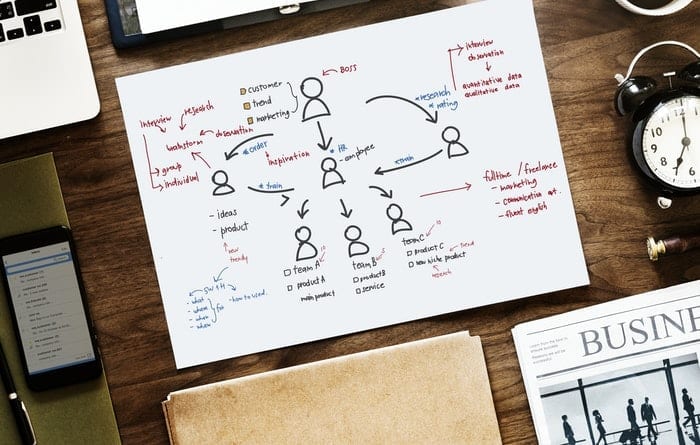

A lot of startups gather money without any clear idea on how much they need, what they should do, or how to execute their business. If you have a detailed plan, investors will not hesitate to choose your company because you have a lot of information about your business growth. Of course, investors want to know how their money will grow in your business and when they can expect revenue. This is part of the detailed plan that you will explain to them and make sure to stick to it.

You Need to Put a Borderline Between Business and Personal Finances

After the process of business registration, you should open a business bank account. You should always keep your personal and business accounts separate because it will help you manage finances better.

A borderline between them is going to provide you with a more straightforward accounting by the end of the year for tax ascertainment. It is also going to get rid of the cash crunch situations in businesses because of the withdrawals made for personal expenses. You should choose to strictly separate the credit cards and loans for your business. It should not be used for personal finances and vice versa.

Calculate Your Monthly Minimum Profit

When you are planning the amount needed to keep your business running, you can get complicated numbers. Think of a good system for expenses and your regular obligations so that you will know how much you should be earning every month. Since income is very easy to calculate, be very strict on your target regarding how much you should be earning. Without that attitude, accounting can become confusing to you and your business might suffer. In addition, you will be able to see if you are spending more than what you earn because aside from your expenses, you should save too. Any wise spender knows that no matter how much your business is earning, you can still go broke or land in debt.

When you think about it, a lot of business owners in Hong Kong have stayed on top. They know how to manage their finances wisely and continue to read and learn. This is something that you can apply if you plan to open a business in Hong Kong.